Catalysts for 2015-2016:

Q1, 2015: Metallurgical Study Results

Q1, 2015: Resource Update to upgrade resources to Indicated Category

Q2, 2015: Preliminary Economic Assessment

Q2, 2015: Commencement of Phase III Drilling at 25 meter centers

Q4, 2016: Completion of Bankable Feasibility Study

Project Overview:

Project Overview:

The 100% owned Paul Isnard Gold Project is located in north-west French Guiana, in South America, 180 kilometres west of the capital, Cayenne, and 80 kilometres south of the department capital, Saint-Laurent-du-Maroni. French Guiana is an overseas department and region of France. Current work is focused on the Montagne d'Or gold deposit which hosts a NI-43-101 in-pit gold resource of

3.9 million ounces Indicated and 1.1 million ounces Inferred (83.2 million tonnes @ 1.45 g/t gold, and 22.4 million tonnes @ 1.55 g/t gold, respectively, at a 0.4 g/t cut-off).

The Paul Isnard project is comprised of eight mining concessions covering an area of 190 km

2 and is accessible via an all season forest road from the town of Saint-Laurent-du-Maroni, for a distance of 120 kilometres, and by small aircraft to the project's base camp. Several roads crisscross the mining concessions providing truck access.

At Montagne d'Or, the gold mineralisation is hosted within a 400 metre thick sequence of intercalated felsic and mafic volcanic and subordinate volcaniclastic rocks that strike east-west and dip steeply south. The near surface gold resources are contained within four closely-spaced stratiform, sub-parallel, east-west-striking and south-dipping sulphide mineralised horizons, which include the principal UFZ and LFZ having average thicknesses of 50 metres and 17.5 metres, respectively. Gold mineralisation is associated with disseminated and stringer sulphides with occasional semi-massive seams to several centimetres in width, mainly as pyrite, and is accompanied by pervasive alteration, which includes sericite, secondary biotite (retrograded to chlorite) and secondary K-feldspar ± quartz. Only a small portion of the deposit has been subjected to upper level oxidation.

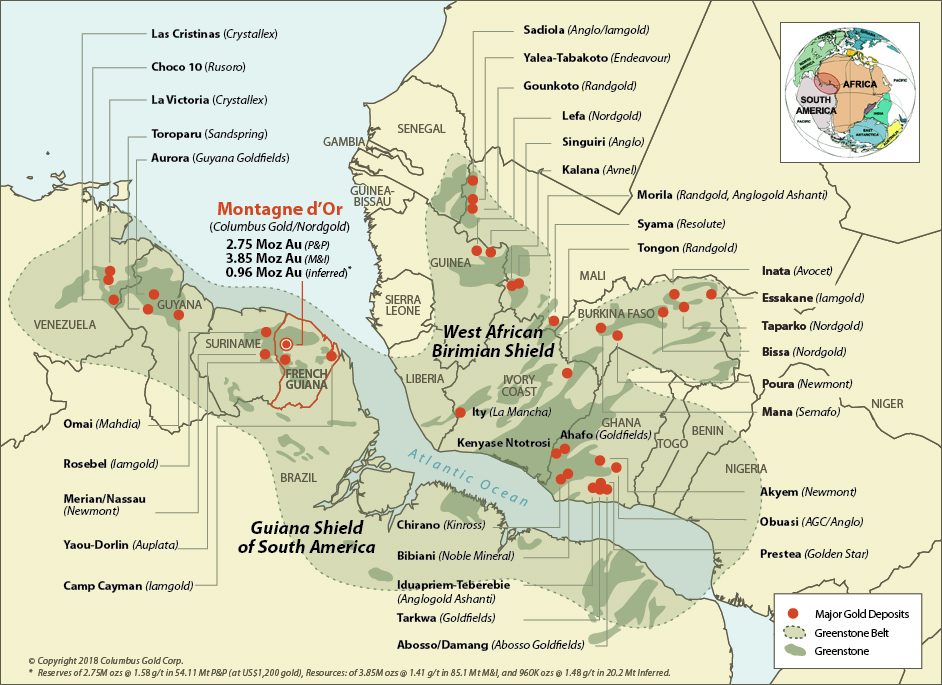

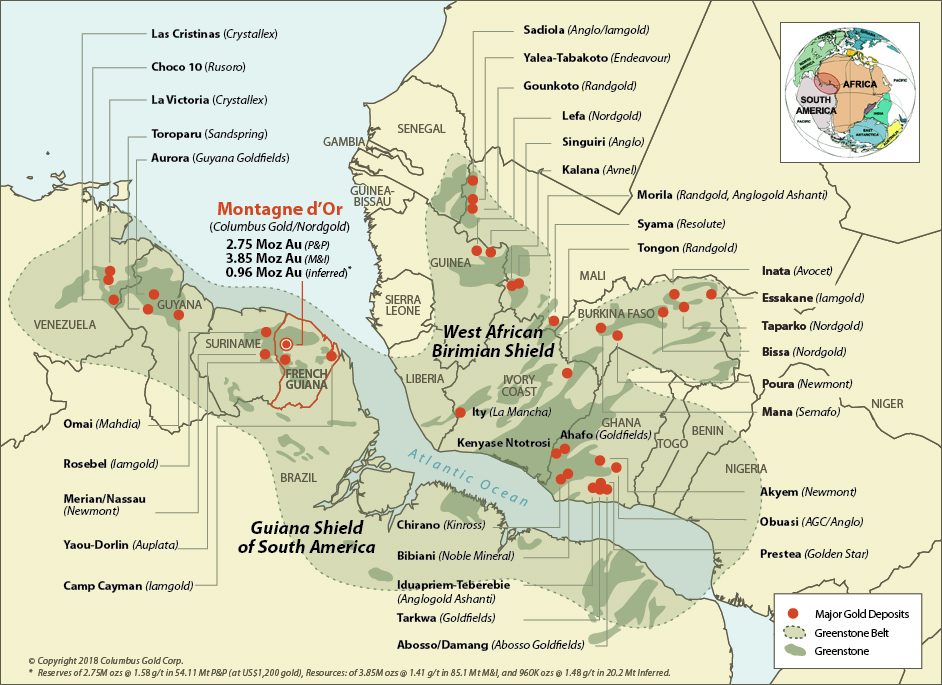

The Paul Isnard Gold Project occurs within the Guiana Gold Belt which stretches from western Venezuela eastward through Guyana, Surinam and French Guiana and into Brazil. Mineral deposits are typical of those in other greenstone terrains such as in Canada, Australia and West Africa. Many significant gold deposits and prospects have been identified on the Guiana Gold Belt, including Las Cristinas, Choco, Toropoaru, Aurora, Omai, Gros Rosebel, Merian and Camp Caiman. Numerous other prospects, mostly in Guyana and Surinam are undergoing active exploration.

Historical Exploration:

Historical Exploration:

Modern exploration at Paul Isnard includes geological, geochemical and geophysical surveys, and diamond core drilling carried out primarily from 1996 to 1999. Most of this work included 54 holes for 10,600 metres directed at the Montagne d'Or gold deposit which delineated an inferred gold resource of 1.9 million ounces from 36.7 million tonnes grading 1.6 gpt gold; applying a cut-off grade 0.4 gpt.

Resource estimates on Montagne d'Or: 1999 (Guyanor-Golden Star), 2004 (RSG Global) and 2008 and 2011 (SRK).

Exploration Work Completed by Columbus Gold:

In late 2012, Columbus completed a Phase I drilling program that consisted of 15,824 metres in 45 core holes at the Montagne d'Or gold deposit.

A Phase II resource development in-fill drill program was completed in November 2014, consisting of 25,570 meters in 126 holes. The program was designed to complete a 50 meter spacing array to a vertical depth of 200 m along the full 2500 meter strike extent of the current resource model. The 50-meter drill pattern is expected to internally increase the resources between widely spaced holes, convert much of the inferred resource to the indicated and measured categories, and provide confidence in the grade-width distribution. In addition, concurrent metallurgical and baseline environmental studies will be completed leading to a resource update and preliminary economic assessment in early 2015.

On September 2013, Columbus Gold entered into an option agreement with Nordgold (LSE: NORD). Under the agreement, Nordgold may earn a 50.01% interest in certain licences at the Paul Isnard Gold Project by completing a bankable feasibility study and by expending not less than US$30 million in 3 years in staged work expenditures, which includes a requirement for Nordgold to pay Columbus Gold $4.2 million in cash no later than May 21, 2014.

During the earn-in period, Columbus Gold will act as operator on the Paul Isnard Gold Project and charge a 10% management fee on certain expenditures. For complete details of the agreement please see Columbus Gold's news release dated September 18, 2013.

September 18, 2013

On March 14, 2014, the definitive option agreement was signed with Nordgold and the $4.2 million payment was made to Columbus Gold. For complete details of the definitive agreement please see Columbus Gold's news release dated March 14, 2014.

March 14, 2014

Mineral Resource Estimate:

For complete disclosure of the mineral resource refer to the news release dated June 30, 2014. For parameters and methods used to estimate the mineral resources please refer to the Mineral Resource Estimate NI 43-101 Technical Report, Coffey Mining, August, 2014, available on this website and also filed on www.Sedar.com.

Drill Results:

Please refer to the following news releases from 2014 highlighting drill results from the Phase II drill program:

February 19, 2014

March 12, 2014

April 30, 2014

May 29, 2014

September 9, 2014

September 11, 2014

October 28, 2014

December 16, 2014

To view the highlights of the Phase II Drill Plan:

www.columbusgoldcorp.com/i/nr/2014-12-16-drillplan.pdf

Metallurgical Work Completed to Date:

Results from a comprehensive metallurgical test work reviewed three gold recovery process options on master composites including: 1) whole-ore cyanidation, 2) a combination of gravity concentration followed by cyanidation of gravity tailing, and 3) gravity concentration followed by gold flotation from the gravity tailing. The test work indicates that the ore types of the principal Upper Felsic Zone ("UFZ") and subsidiary Lower Favorable Zone ("LFZ") are highly amenable to the three metallurgical processes tested, with recoveries of gold ranging from 95% to 97%.

Please refer to the following news release highlighting metallurgical results from the initial metallurgical program completed in 2014:

January 8, 2015

Rock Lefrançois, P.Geo. (OGQ), Columbus Gold's COO and Qualified Person has reviewed and approved the technical content of this project description.